Mortgage Loan Underwriting Explained: 7 Powerful Steps to Approval

Buying a home is one of the most exciting milestones in life—but getting approved for a mortgage can feel like navigating a maze. In this comprehensive guide, mortgage loan underwriting explained will demystify the entire process, breaking down every critical step so you can walk in with confidence and come out with keys in hand.

What Is Mortgage Loan Underwriting Explained?

At its core, mortgage loan underwriting explained is the behind-the-scenes evaluation process lenders use to determine whether a borrower qualifies for a home loan. It’s not just about checking a credit score—it’s a holistic review of your financial health, the property’s value, and the overall risk to the lender.

The Role of the Underwriter

An underwriter is a financial professional who analyzes your loan application with a fine-tooth comb. They work for the lender or a third-party service and are responsible for verifying that you meet all the criteria set by the loan program—be it conventional, FHA, VA, or USDA.

- Assesses creditworthiness and repayment ability

- Verifies income, assets, and employment

- Evaluates the property’s value and condition

According to the Consumer Financial Protection Bureau (CFPB), underwriters use automated systems and manual reviews to ensure compliance with federal and institutional guidelines.

Why Underwriting Matters

Without underwriting, lenders would have no reliable way to measure risk. This process protects both the borrower and the lender. For borrowers, it ensures they’re not approved for a loan they can’t afford. For lenders, it minimizes the chance of default.

“Underwriting is the backbone of a stable mortgage market. It ensures that loans are made responsibly and sustainably.” — Mortgage Bankers Association

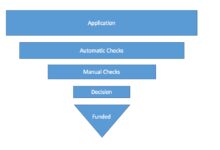

Mortgage Loan Underwriting Explained: The 7-Step Process

Understanding the step-by-step journey of mortgage loan underwriting explained can reduce anxiety and help you prepare effectively. Here’s how it typically unfolds:

Step 1: Pre-Approval and Application Submission

Before you even start house hunting, getting pre-approved gives you a competitive edge. During this phase, you provide basic financial information—credit score, income, debts, and assets—and the lender issues a pre-approval letter stating how much you may borrow.

- Pre-approval is not a guarantee but shows sellers you’re serious

- Lenders perform a soft or hard credit check

- You’ll need to fill out a Uniform Residential Loan Application (Form 1003)

This initial screening helps the lender determine if you meet minimum eligibility requirements before diving into full underwriting.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

Step 2: Document Collection and Verification

Once you’ve made an offer on a home and signed a purchase agreement, the formal underwriting process begins. You’ll need to submit a comprehensive package of documents, including:

- Pay stubs (last 30 days)

- W-2s and tax returns (last two years)

- Bank and investment account statements

- Proof of employment (employer letter if self-employed)

- Gift letters (if using gifted funds)

- Divorce decrees or child support agreements (if applicable)

The underwriter will verify every piece of information. For example, they might call your employer to confirm your job status or request additional explanations for large deposits in your bank account.

Step 3: Credit Evaluation

Your credit history is a major factor in mortgage loan underwriting explained. The underwriter will pull your credit report from one or more of the three major bureaus—Equifax, Experian, and TransUnion.

- Checks for late payments, collections, bankruptcies, or foreclosures

- Calculates your credit score (FICO score is most commonly used)

- Looks at credit utilization and length of credit history

Most conventional loans require a minimum FICO score of 620, while FHA loans may accept scores as low as 580 for a 3.5% down payment. A higher score often leads to better interest rates and terms.

Step 4: Income and Employment Verification

Stable income is crucial. The underwriter will analyze your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income.

- Front-end DTI: housing costs ÷ gross income

- Back-end DTI: all debts ÷ gross income

- Most lenders prefer a back-end DTI below 43%, though some allow up to 50% with strong compensating factors

For self-employed borrowers, this step can be more complex. You may need to provide two years of tax returns and profit-and-loss statements to prove consistent income.

Step 5: Property Appraisal

The home you’re buying isn’t just your future residence—it’s collateral for the loan. An appraisal ensures the property is worth the amount you’re borrowing.

- A licensed appraiser inspects the home and compares it to similar recently sold properties (comps)

- Checks for structural issues, safety concerns, and overall condition

- Must meet minimum property requirements (MPRs) set by Fannie Mae, Freddie Mac, or the FHA

If the appraisal comes in lower than the purchase price, the lender may not approve the full loan amount. In such cases, you may need to renegotiate the price, make a larger down payment, or challenge the appraisal.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

Step 6: Title Search and Insurance

Before closing, a title company conducts a search to ensure the seller legally owns the property and that there are no liens, unpaid taxes, or legal disputes.

- Identifies any encumbrances on the property

- Ensures clear title transfer

- Requires title insurance to protect against future claims

This step is critical in mortgage loan underwriting explained because the lender needs assurance that their investment is secure. Without clear title, the loan cannot proceed.

Step 7: Final Underwriting Decision

After all documentation, credit checks, appraisals, and title work are complete, the underwriter makes one of four decisions:

- Approve: You’re cleared to close

- Approve with Conditions: You must provide additional documents or meet specific requirements

- Refer to Underwriter: A more senior underwriter needs to review the case

- Deny: The loan is not approved

If approved with conditions, don’t panic. This is common. You might be asked to provide a letter of explanation for a credit inquiry or proof of a new job. Once conditions are met, the loan moves to the closing department.

Mortgage Loan Underwriting Explained: Common Challenges and How to Overcome Them

Even with a solid financial profile, underwriting can throw curveballs. Being aware of common pitfalls can help you stay on track.

Low Credit Score or Spotty Credit History

A low credit score is one of the most frequent reasons for underwriting delays or denials. However, it’s not always a deal-breaker.

- Consider credit repair before applying—dispute errors, pay down balances, and avoid new credit inquiries

- Explore government-backed loans like FHA, which are more forgiving

- Work with a credit counselor approved by the National Foundation for Credit Counseling (NFCC)

Improving your score by even 20-30 points can significantly boost your chances of approval.

High Debt-to-Income Ratio

If your DTI is above 43%, lenders may see you as overextended. But there are ways to improve your standing.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

- Pay off credit card balances or consolidate debt

- Delay large purchases (like a new car) before applying

- Consider a co-borrower with strong income

Some loan programs allow higher DTIs if you have strong reserves, excellent credit, or a large down payment.

Insufficient Down Payment or Reserves

While some loans allow low or no down payments, lenders often look for cash reserves—typically two to six months of mortgage payments in the bank.

- Use gift funds (with a proper gift letter)

- Tap into retirement accounts (with caution)

- Explore down payment assistance programs

For first-time buyers, state and local housing finance agencies often offer grants or low-interest loans.

Mortgage Loan Underwriting Explained: Types of Underwriting Systems

Not all underwriting is done by humans. In fact, most conventional loans are evaluated using automated underwriting systems (AUS). These tools speed up the process and reduce subjectivity.

Fannie Mae’s Desktop Underwriter (DU)

DU is one of the most widely used AUS platforms. It analyzes your application and provides a risk assessment and recommendation.

- Can approve, refer, or deny a loan

- May request additional documentation even if approved

- Accepts data from loan origination systems and tax transcripts

According to Fannie Mae, DU helps lenders make faster, more consistent decisions while maintaining risk standards.

Freddie Mac’s Loan Product Advisor (LPA)

LPA is Freddie Mac’s equivalent to DU. It evaluates loan applications for compliance with Freddie Mac’s guidelines.

- Provides findings such as “Approve/Eligible,” “Refer/Ineligible,” or “Caution”

- Can assess non-traditional credit data for borrowers with limited credit history

- Integrates with lender systems for seamless data flow

Both DU and LPA are powerful tools in mortgage loan underwriting explained, especially for standardized loan products.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

Manual Underwriting: When Automation Isn’t Enough

Some borrowers don’t fit the automated mold—self-employed individuals, those with complex income structures, or applicants with credit issues. In these cases, manual underwriting is required.

- Conducted by a human underwriter

- Takes longer—often 2-4 weeks

- Requires more documentation and justification

Manual underwriting is more flexible but also more rigorous. It allows for a deeper understanding of your financial story, which can be an advantage if you have strong compensating factors.

Mortgage Loan Underwriting Explained: Key Documents You’ll Need

Being prepared with the right paperwork can speed up the underwriting process and reduce stress. Here’s a checklist of the most commonly requested documents.

Proof of Identity and Residency

Lenders need to verify who you are and where you live.

- Government-issued ID (driver’s license, passport)

- Social Security card

- Utility bills or lease agreement for proof of address

Income Verification Documents

These documents prove you have the income to repay the loan.

- Recent pay stubs (last 30 days)

- W-2 forms (last two years)

- 1099 forms (for contractors or freelancers)

- Two years of federal tax returns (with all schedules)

- Profit and loss statements (for self-employed)

- Employment verification letter

If you’ve changed jobs recently, be ready to explain the transition. Lenders prefer stability, but a promotion or lateral move within the same industry is usually acceptable.

Asset and Down Payment Documentation

Lenders want to see that you have enough money for the down payment and closing costs.

- Bank statements (last two months)

- Investment account statements

- Retirement account statements (if using funds)

- Gift letters (if someone is helping with the down payment)

- Explanation of large deposits

Any deposit that can’t be traced to a paycheck or regular income source will likely require an explanation.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

Mortgage Loan Underwriting Explained: How Long Does It Take?

One of the most common questions in mortgage loan underwriting explained is: “How long will this take?” The answer varies, but here’s a general timeline.

Typical Underwriting Timeline

On average, the underwriting process takes 1 to 2 weeks, but it can extend to 3-4 weeks depending on complexity.

- Pre-approval: 1-3 days

- Document submission: 1-2 days

- Appraisal: 7-10 days

- Underwriting review: 3-7 business days

- Clear to close: 1-2 days after conditions are met

Delays often occur due to missing documents, appraisal issues, or high lender volume.

Factors That Can Speed Up or Slow Down the Process

You’re not powerless in this process. Your actions can influence the timeline.

- Speed it up: Respond quickly to document requests, stay in contact with your loan officer, and avoid making major financial changes

- Slow it down: Opening new credit accounts, changing jobs, or making large purchases can trigger red flags

According to Ellie Mae’s Origination Insights Report, the average time from application to closing was 44 days in 2023, with underwriting being a major component.

What to Do While You Wait

Waiting for underwriting can be stressful. Use this time wisely.

- Review your homeowner’s insurance options

- Start planning for moving logistics

- Continue saving for closing costs and reserves

- Stay in touch with your loan officer for updates

Being proactive can help you avoid last-minute surprises.

Mortgage Loan Underwriting Explained: Tips for a Smooth Approval

Want to increase your chances of a smooth underwriting experience? Follow these expert tips.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

Be Honest and Thorough

Never exaggerate income or hide debts. Underwriters are trained to spot inconsistencies, and misrepresentation can lead to loan denial or even legal consequences.

- Disclose all sources of income

- Report all debts, even small ones

- Provide complete and accurate documentation

Keep Financial Activity Stable

Once you apply, treat your finances like a no-go zone.

- Don’t open new credit cards or take on new debt

- Don’t make large deposits without documentation

- Don’t quit your job or switch careers

Lenders re-check your credit and employment status right before closing. Any major changes can jeopardize your loan.

Work With an Experienced Loan Officer

A knowledgeable loan officer can guide you through the maze of mortgage loan underwriting explained. They can anticipate issues, help you prepare documents, and advocate for you with the underwriting team.

- Ask about their experience with similar borrowers

- Choose someone responsive and communicative

- Get recommendations from friends or real estate agents

What is mortgage loan underwriting?

Mortgage loan underwriting is the process lenders use to evaluate a borrower’s creditworthiness, income, assets, and the property’s value to determine if they qualify for a home loan. It involves verifying documents, running credit checks, and assessing risk.

How long does mortgage underwriting take?

Typically, mortgage underwriting takes 1 to 2 weeks, but it can take longer depending on the complexity of the loan, the borrower’s financial situation, and lender workload. Automated underwriting can speed up the process.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

What do underwriters look for?

Underwriters look at your credit score, debt-to-income ratio, employment history, income stability, assets, and the property’s appraised value. They verify all information to ensure you can repay the loan and the home is adequate collateral.

Can I be denied during underwriting?

Yes, you can be denied during underwriting if you don’t meet the loan program’s requirements. Common reasons include low credit score, high DTI, insufficient income, or a low appraisal. However, you may be able to appeal or reapply with improvements.

What does ‘clear to close’ mean?

‘Clear to close’ means the underwriter has approved your loan, all conditions have been met, and the lender is ready to schedule your closing. It’s the final step before you sign documents and get the keys to your home.

Mortgage loan underwriting explained is more than just a box-checking exercise—it’s a thorough financial evaluation that ensures you’re set up for long-term homeownership success. From document collection to final approval, each step plays a crucial role in determining your eligibility. By understanding the process, preparing the right paperwork, and avoiding common pitfalls, you can navigate underwriting with confidence. Whether you’re a first-time buyer or a seasoned homeowner, knowledge is your greatest asset. Stay informed, stay organized, and you’ll be one step closer to unlocking the door to your dream home.

mortgage loan underwriting explained – Mortgage loan underwriting explained menjadi aspek penting yang dibahas di sini.

Further Reading: